Meet the Modern Core for any Microfinance

Transform how you manage microfinance operations with our all-in-one platform. From loan processing to reporting, bring speed and reliability to every workflow.

Powering with the best

Integrate with your favorite tools

Connect seamlessly with popular platforms and services to enhance your workflow.

Open AI

Ask the AI agents about to analyze and generate reports for you.

Bank Of Lao

Sending monthly reports to Bank Of Lao is effertless and accurate.

BCEL

Once loan approved, and get your money direct to your Bank acccount.

M Money

Fincore and M Money connecting seamlessly and bi-directionaly.

Lao Development Bank

LDB is your favorite? Fincore can be integrated to reduce efforts.

Unitel Laos

Get verified by Unitel KYC to faster loan approvals.

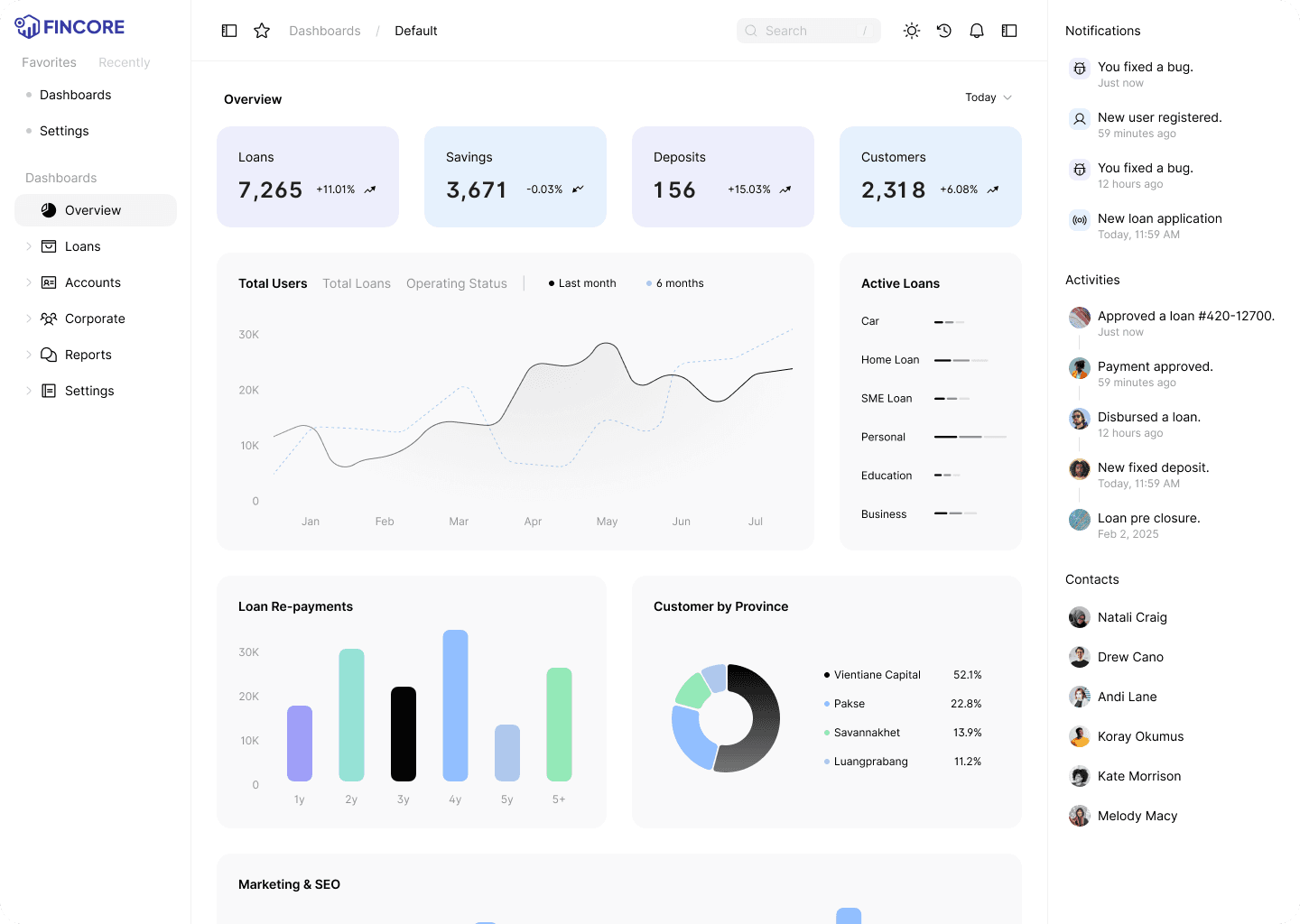

Mission-Critical Core Banking

Fincore powers the next generation of microfinance institutions with a cloud-native, scalable, and secure platform designed for growth.

Trusted by modern financial institutions

See how Fincore is helping microfinance institutions around the world drive growth and operational excellence.

"Fincore’s ledger accuracy is unmatched. We migrated 500k accounts with zero discrepancies, and the real-time reconciliation has saved us countless hours."

"Our field agents doubled their efficiency with the Fincore mobile app. Collecting repayments and onboarding customers in remote villages is now seamless."

"The API capabilities are improved. We integrated Fincore with our existing credit scoring engine and payment gateways in under two weeks."

"We finally have real-time visibility into our Non-Performing Loans. The analytics dashboard helps us proactively manage risk before it becomes a problem."

"Customer onboarding time dropped from 2 days to 10 minutes. The automated KYC workflows have completely transformed our customer experience."

"Fincore’s ledger accuracy is unmatched. We migrated 500k accounts with zero discrepancies, and the real-time reconciliation has saved us countless hours."

"Our field agents doubled their efficiency with the Fincore mobile app. Collecting repayments and onboarding customers in remote villages is now seamless."

"The API capabilities are improved. We integrated Fincore with our existing credit scoring engine and payment gateways in under two weeks."

"We finally have real-time visibility into our Non-Performing Loans. The analytics dashboard helps us proactively manage risk before it becomes a problem."

"Customer onboarding time dropped from 2 days to 10 minutes. The automated KYC workflows have completely transformed our customer experience."